Beyond Chatbots: Why Private Equity Needs Intelligent HUDs

Beyond Chatbots: Why Private Equity Needs Intelligent HUDs

This article was co-written with Bodic, a Paris-based firm specializing in AI strategy and data governance for private market professionals.

The private equity industry has enthusiastically adopted AI chatbots, and quickly discovered their limitations. While chatbots excel at answering simple questions, they fall short when professionals need to analyze complex deals, synthesize hundreds of documents, or make time-sensitive investment decisions.

The problem isn't AI itself. It's the interface.

The Chatbot Bottleneck

Investment teams face a fundamental challenge with traditional chatbots:

Cognitive Overload: Users must describe their entire context from scratch. When analyzing a potential acquisition, you shouldn't need to explain what you're looking for, repeat key details, or specify your exact requirements every time.

Context Blindness: Chatbots don't know what you're working on. They can't see that you're reviewing a data room, updating a DDQ, or preparing for an IC meeting. This lack of awareness creates friction and wastes valuable time.

Question-Answer Trap: M&A professionals don't work in Q&A mode. They need to compare, cross-reference, validate, and synthesize. Chatbots force you into an unnatural workflow that doesn't match how deals actually progress.

The Hidden Cost: Every interaction requires explanation. This cognitive tax adds up—turning what should be seconds into minutes, and minutes into hours across your deal pipeline.

Enter the Intelligent HUD

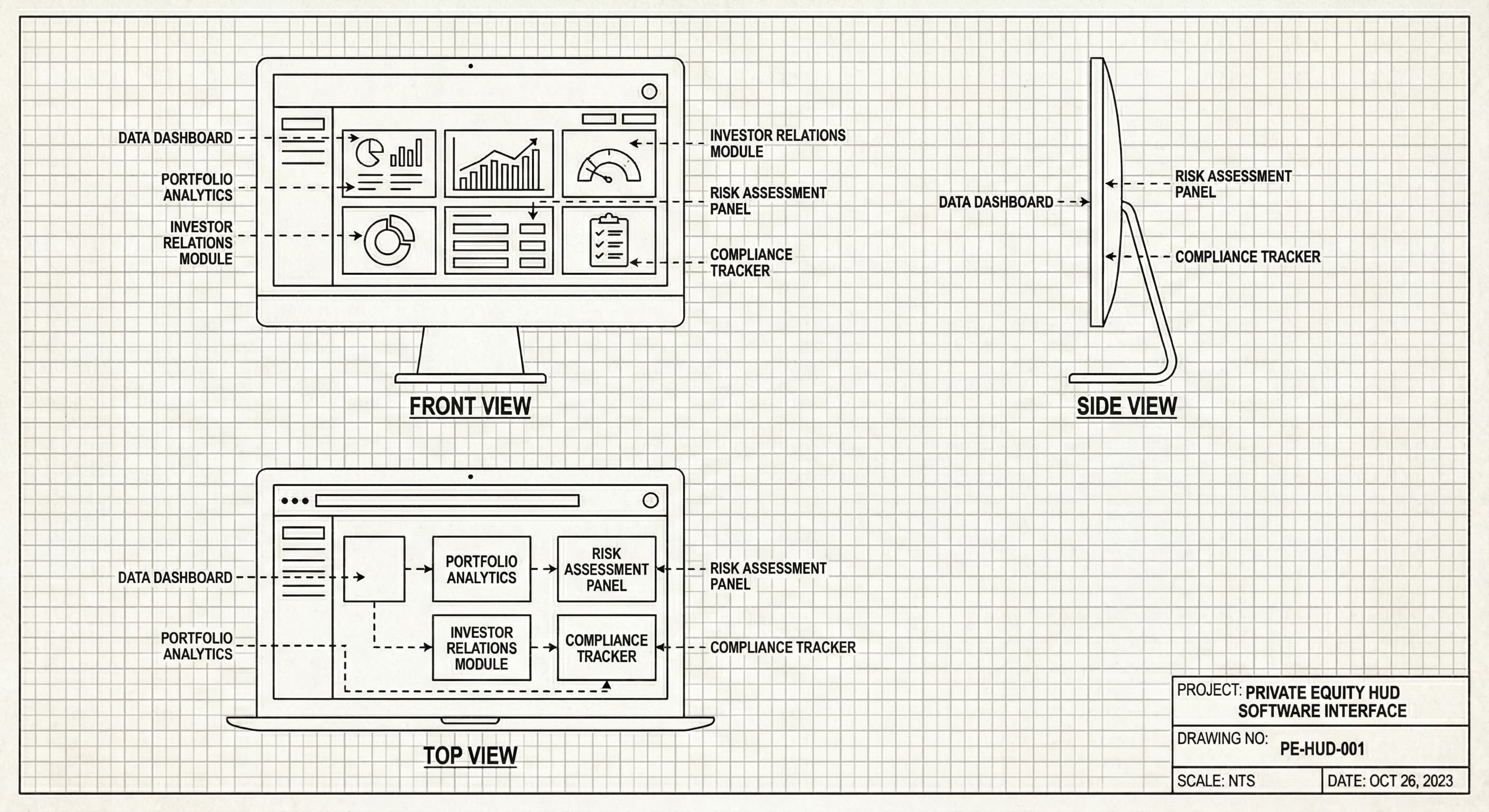

A Heads-Up Display (HUD) isn't a conversation window—it's a contextual intelligence layer embedded directly in your workflow. Like a fighter pilot's HUD that shows critical information without requiring questions, an intelligent HUD surfaces insights exactly when and where you need them.

The Fundamental Shift

Context Replaces Prompts: The system already knows you're in a data room reviewing financials. It understands the deal, the sector, and your firm's investment criteria. No explanation needed.

Streaming Intelligence: Instead of static file processing, the HUD operates on real-time data flows. As documents arrive, contracts are signed, or diligence progresses, the intelligence updates automatically. You're never working with stale information.

Governance as Foundation: In regulated environments like private equity, every AI output must be traceable, auditable, and compliant. The HUD doesn't just provide answers—it shows its reasoning, cites specific sources, and maintains a complete audit trail. This isn't optional; it's foundational for GDPR and DORA compliance.

How Callisto Implements Intelligent HUDs

At Callisto, we've built our platform around three core principles that make HUDs effective for private equity:

1. Unified Context & Shared Environment

Unlike chatbots that start fresh each time, Callisto maintains persistent context across your entire deal lifecycle. When you open a data room, review a DDQ, or prepare an investment memo, the AI already understands:

- The target company and sector

- Your firm's investment thesis

- Historical due diligence findings

- Relevant comparable transactions

- Key risk factors from similar deals

This shared context eliminates the "cold start" problem that plagues chatbots.

2. Proactive HUD Approach

Instead of waiting for questions, Callisto pushes relevant intelligence to you:

- In Data Rooms: New documents trigger automatic red flag detection, missing signature alerts, and GDPR exposure warnings

- During DDQ Responses: The system surfaces relevant answers from your master DDQ and past responses, pre-filled and ready for review

- Before IC Meetings: Key metrics, risk factors, and comparable analysis appear automatically in your investment memo template

3. Traceability & Auditability

Every insight the HUD provides is linked to its source. When Callisto flags a contract issue, it shows you the exact paragraph, document version, and relevant clause. When it suggests a DDQ response, you see which previous answers and knowledge base entries informed it.

This isn't just good UX—it's mandatory for regulated financial institutions that need to demonstrate AI governance and compliance.

Real-World Impact: The DDQ Example

Consider how traditional chatbots versus intelligent HUDs handle DDQ responses:

Chatbot Approach:

- Open questionnaire

- Read question about GDPR compliance

- Open chat window

- Type: "What's our firm's GDPR compliance approach?"

- Wait for response

- Copy and paste answer

- Repeat for 50+ questions

Intelligent HUD Approach:

- Open questionnaire

- HUD automatically identifies question type

- Pre-filled answer appears, sourced from your master DDQ and compliance documents

- Review, adjust if needed, approve

- Move to next question

The time savings compound: what took 15 hours now takes 2. But more importantly, consistency improves, compliance risk drops, and senior professionals can focus on strategic questions instead of repetitive documentation.

Looking Ahead

The shift from chatbots to intelligent HUDs represents the next evolution of AI in professional services. As the technology matures, we'll see:

- Real-time collaboration features where multiple team members work in shared, AI-enhanced environments

- Automatic updates as new information becomes available during diligence

- Integration with deal management and portfolio monitoring tools

- Cross-deal pattern recognition that improves with every transaction

For private equity firms, this isn't just about efficiency, it's about competitive advantage. In a market where speed and accuracy determine which deals you win, having intelligence embedded in your workflow isn't optional.

The future of AI in finance isn't asking better questions. It's building better environments where questions become unnecessary.

Want to see intelligent HUDs in action? Schedule a demo to experience how Callisto transforms your deal workflow with embedded AI intelligence.

Ready to Transform Your Investment Process?

See how Callisto can accelerate your deal flow and improve due diligence.

Request a Demo